What is GST Registration?

In any tax system, registration is the most fundamental requirement for identification of tax payers that ensures tax compliance in the economy. Registration of any business entity under the GST Law implies obtaining a unique identification number from the concerned tax authorities for the purpose of collecting tax on behalf of the government and availing input tax credit for the taxes on his inward supplies. A person can neither collect

tax from his customers nor claim any input tax credit of tax paid by him without registration.

1. GST Explained

Goods and Services Tax (“GST”) is the indirect tax levied in India, abolishing and subsuming different taxes such as service tax, excise duty, VAT, entry tax and

customs duty, into a single tax system. GST was introduced in India in order

to reduce complexities and compliances of doing business for millions of small

businesses in India.

2. Why GST Registration?

Under the new GST regime, all entities involved in buying or selling of goods or providing services or both are required to register for GST. Entities without GST registration would not be allowed to collect GST from a customer or claim input tax credit of GST paid or they could be penalized. Further, registration under GST is mandatory once an entity crosses the minimum threshold turnover limit or starts a new business that is expected to cross the prescribed turnover.

3. GST Annual Turnover

As per the GST Council, entities in special category states with an annual turnover of Rs.10 lakhs and above would be required to register under GST. All other entities in the rest of India would be required to register under GST if the annual turnover exceeds Rs.20 lakhs. There are also various other criteria, that could make an entity liable for obtaining GST registration – irrespective of annual sales turnover.

Our Packages

GST Registration is mandatory for

Documents Required for Online GST Registration

The list of documents required for registration of GST for various business are as follows

What is GSTIN?

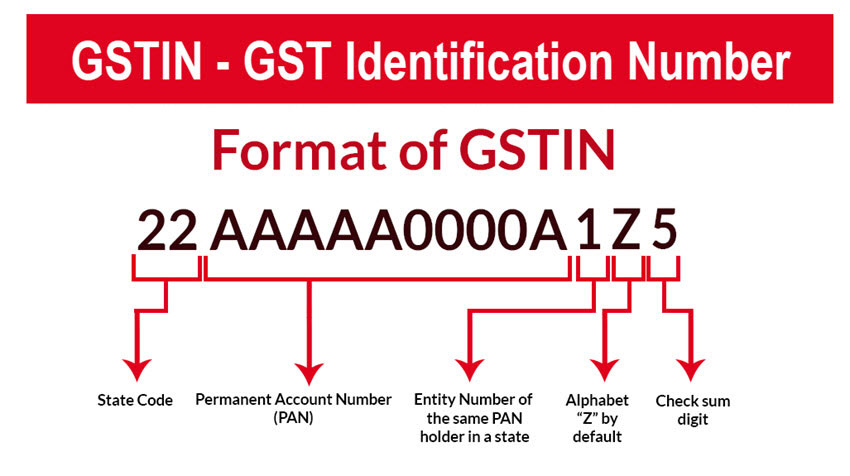

GSTIN is a unique identification number given to each GST tax payer. A person who has a GST number can log onto the GST portal to verify a GSTIN number. Each taxpayer is assigned a state-wise PAN-based 15-digit Goods and Services Taxpayer Identification Number (GSTIN).

Here is a format break-down of the GSTIN:

The first two digits represent the state code as per Indian Census 2011. Every state has a unique code.

- For instance, State code of Karnataka is 29

State code of Maharashtra is 22 - The next ten digits will be the PAN number of the taxpayer

- The thirteenth digit will be assigned based on the number of registration within a state

- The fourteenth digit will be the alphabet ‘Z’ by default

- The last digit will be for check code. It may be an alphabet or a number.

GST Registration Process

GST Registration FAQs

When should a business apply for multiple GST registrations?

If any business entity supplies goods and services from multiple States, then it mandatorily requires to register under GST in different States. For instance, If a sweet vendor sells in Gujarat and Maharashtra, he has to apply for separate GST registration in Gujarat and Maharashtra respectively.

Further, any business entity can apply for multiple GST registration even if it is operating from single State under multiple verticals to avoid accounting complexity between multiple businesses. For instance, XYZ Private Limited doing the business of selling merchandise and also doing the business of selling software from Mumbai only. Still, it can apply for multiple GST Registration for their different business domains.

Can I take GST registration voluntarily?

Yes, you can voluntarily apply for GST Registration even if your business annual turnover does not exceed threshold limit Rs 20 lakhs in a financial year (Rs 10 lakhs for North Eastern and hill states).

GST registration helps you not only in getting your business recognized as a legal registrant but also in availing various benefits like avail to raise GST Invoice, avail input tax credit, and much more if you voluntarily take GST Registration.

Is there any penalty for not registering under GST?

If any business entity mandatorily requires to register under GST, however, fails to apply or intentionally ignores the same then business is liable to pay the penalty of 100% of the tax due or INR. 10,000 whichever is higher.

What is a composition scheme and who should opt for it?

Composition Scheme is a simple and easy scheme under GST for taxpayers. Small taxpayers can get rid of tedious GST formalities and complexities and pay GST at a fixed rate of turnover. Composition Scheme can be opted by any taxpayer whose turnover is below Rs 1.0 crore. The limit is Rs 75 lakh in case of North-Eastern states and Himachal Pradesh.

What are the conditions for availing Composition Scheme under GST?

The conditions to be satisfied in order to opt for composition scheme are as follows:

- A dealer opting for composition scheme under GST cannot claim Input Tax Credit.

- The taxpayer cannot deal in any inter-state supply of goods

- The dealer cannot supply exempted goods under GST

- For transactions under Reverse Charge Mechanism, Taxpayer has to pay tax at normal rates

- A taxable person, having different segments of businesses (such as textile, electronic accessories, groceries, etc.) under the same PAN, must register all such businesses under the scheme collectively or opt out of the scheme.

- The taxpayer has to mention the words ‘composition taxable person’ on every notice or signboard displayed prominently at their place of business.

- The taxpayer has to mention the words ‘composition taxable person’ on every bill of supply issued by him.

- Those supplying goods can provide services of up to Rs. 5 lakh.

Who cannot opt for Composition Scheme?

The following people cannot opt for the scheme:

- Taxpayer supplying exempt supplies under GST

- Supplier of services except restaurant related services

- Manufacturer of ice cream, pan masala, or tobacco

- Casual taxable person or a non-resident taxable person

- Businesses supplying goods through an e-commerce operator

What is HSN Code and SAC Code under GST?

HSN Code

Harmonized System Nomenclature code number, known as HSN Code, is an internationally adopted commodity description and coding system developed by the World Customs Organization (WCO). With the HSN code acting as a universal classification for goods, the Indian Government has decided to adopt the use of HSN code for classification of goods under GST and levy of GST.

SAC Code

Services Accounting Code, known as SAC Code, is a classification system for services developed by the Service Tax Department of India. The GST rates for services are fixed in five slabs namely 0%, 5%, 12%, 18% and 28%, using SAC code. If a service is not exempted from GST or if the GST rate is not provided, then the default GST rate for services of 18% would be applicable.